The home improvement stopping Brits from unlocking their equity.

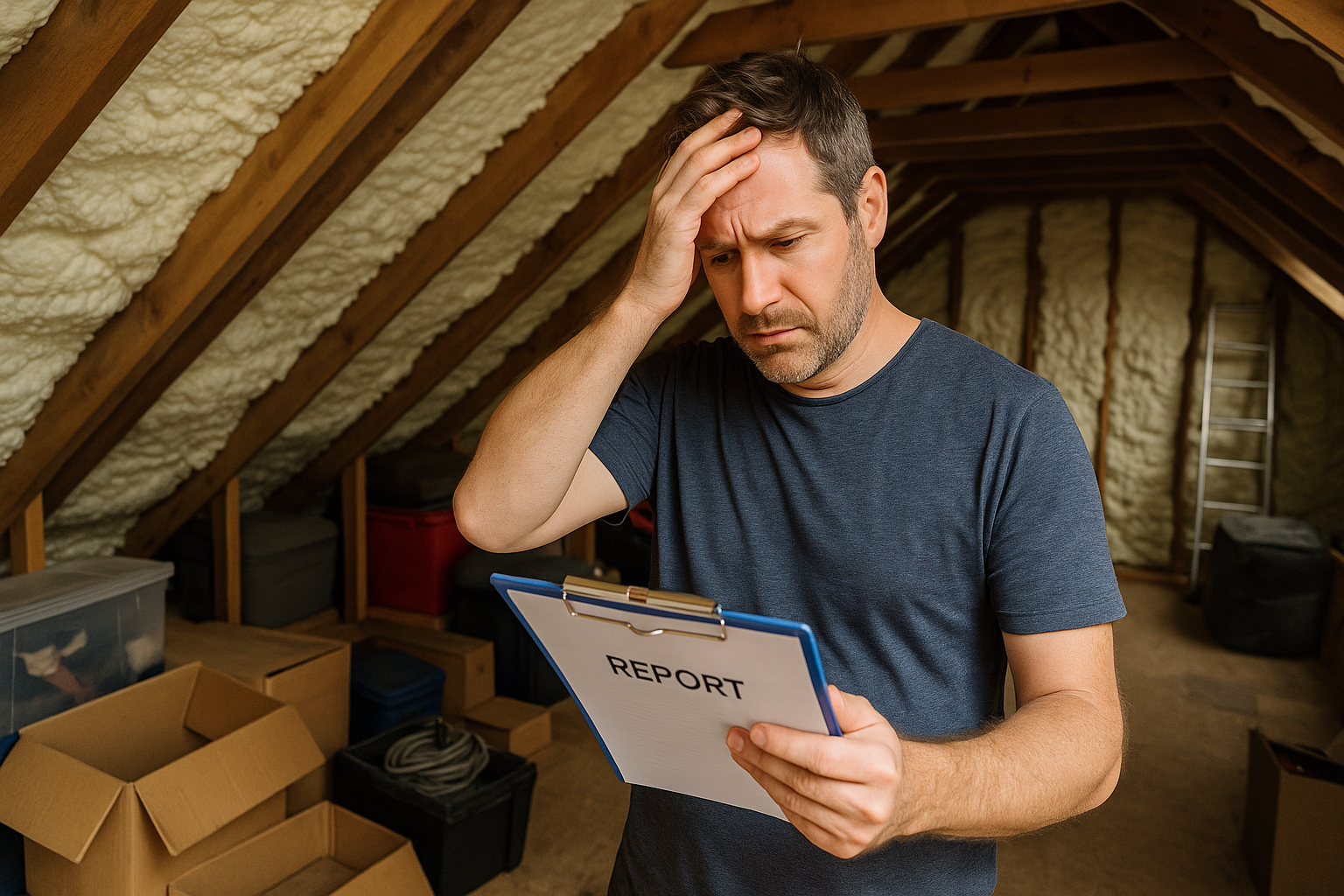

Margaret had it all planned out. At 72, she was ready to enjoy the retirement she’d worked a lifetime for—no debt, a modest bungalow, and a simple plan to release some of the equity in her home to help with the rising cost of living and a few well-earned luxuries.

But a single sentence from her lender changed everything:

"We’re sorry—your property is ineligible due to the presence of spray foam insulation."

That unexpected rejection left her shocked. The insulation had been installed professionally as part of a government-endorsed scheme. It made the house warmer and more energy efficient. How could it now be the very thing blocking her financial plans?

Stories like Margaret’s are becoming increasingly common. Across the UK, many homeowners are discovering that a product once marketed as a home improvement is now a major barrier to accessing the value tied up in their homes.

Understanding Equity Release—and Why Spray Foam Matters

Equity release allows homeowners, typically over 55, to unlock some of the wealth in their property without needing to move out. It’s often used to supplement pensions, pay for care, fund home improvements or support younger family members.

However, many equity release lenders now refuse to approve applications on properties that contain spray foam insulation—particularly when it’s applied to the underside of the roof.

Why This Is a Growing Concern in 2025

The reason is simple: spray foam makes it difficult for surveyors to assess the condition of the roof timbers. Without a clear view of the structure, lenders are understandably cautious. This uncertainty leads many to decline equity release applications outright, regardless of how or when the foam was installed.

Spray foam insulation was heavily promoted under energy efficiency schemes over the past decade, and many homeowners trusted that they were making a responsible upgrade. What wasn’t widely explained at the time was how this decision could impact future property transactions—including equity release.

We’re now seeing the fallout:

- Surveyors struggling to assess roof structures

- Lenders applying blanket policies against spray-foamed properties

- Homeowners being left in limbo with limited options and increasing financial pressure

The presence of spray foam, in many cases, is not flagged until the final stages of an application, leading to unexpected rejections, delays, and distress.

Can Spray Foam Be Removed to Resolve the Issue?

In some cases, lenders may reconsider if an independent roofing specialist can confirm the condition of the structure. However, more often than not, the presence of foam insulation—particularly closed-cell foam—triggers an automatic refusal.

This has led many homeowners to explore removal as a potential solution.

Spray foam removal is possible, but it’s a specialised process that should only be carried out by experienced professionals. Not all firms are equal, and we strongly urge caution when choosing a company—especially in light of recent reports about rogue traders targeting vulnerable homeowners.

Planning Ahead: What Homeowners Can Do Now

If you’re thinking about equity release, or even planning for it in the years ahead, it’s worth taking steps now to understand where you stand.

✅

Check your loft space

Many homeowners are unaware that spray foam was even installed—especially if it was done through a grant scheme or previous owner.

✅

Speak to a specialist adviser

Equity release professionals can help you understand your options and whether spray foam will be a factor in your application.

✅

Consider your long-term goals

If equity release is important to your retirement plan, it may be necessary to weigh up the benefits of removal now, rather than risk rejection later.

Final Thoughts

Spray foam insulation may have seemed like a forward-thinking solution at the time—but as the lending landscape evolves, it's increasingly becoming a roadblock to financial freedom in later life.

At SFACUK, we work every day with homeowners who’ve found themselves in this very situation—blocked from releasing equity, remortgaging, or even selling their home because of spray foam. Many had no idea this was even an issue until it was too late.

If you’re facing uncertainty or simply want to avoid problems down the line, we’re here to help. No pressure, no sales tactics—just clear, unbiased information and support to help you make the best decision for your future.

Your home should fund your future—not hold it hostage.